Wallex

Overseas Payment and

Cash Management Solution

What is Wallex?

Wallex is a modern overseas payment and cash management solution for businesses. You can make international payments, convert FX and even collect with local currencies. In addition, you can also choose to convert and hold balances in multiple currencies, so as to properly plan, manage and hedge all your currency needs within a single platform.

Easier Process, Cheaper Fees & Quicker Transactions

In most situations, you will have to incur high processing fees and expensive FX margins when you make cross-border payments. The process is also lengthy and troublesome. With Wallex, not only can you have the special access to rates that slash your transaction costs by as much as 70%, you are also able to make global payments in a matter of minutes!

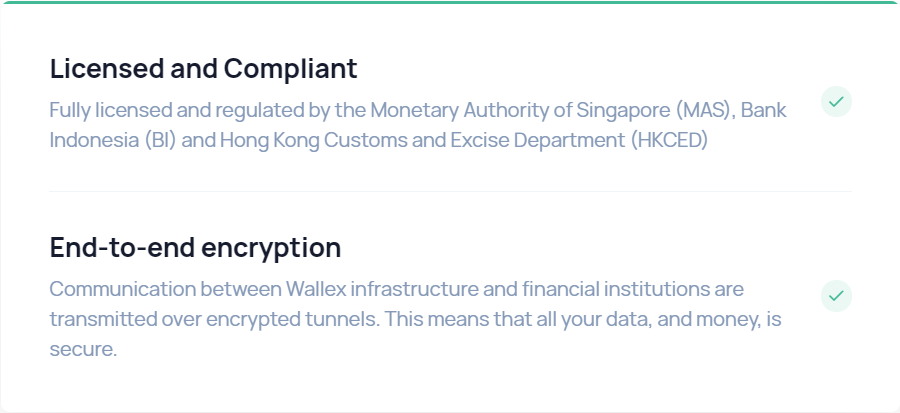

Fully Regulated and Secure

Wallex works closely with financial regulators and maintains the highest security standards to protect your data – and your organisation.

- Licensed and compliant

Wallex is fully licensed and regulated by the Monetary Authority of Singapore (MAS), Bank Indonesia (BI) and Hong Kong Customs and Excise Department (HKCED).

- End-to-end encryption

The communication between Wallex infrastructure and financial institutions are transmitted over encrypted tunnels. This means that all your data, and money, is securely kept within Wallex.

Solutions

Pay

Enjoy low-cost and fast cross-border payments to over 180 countries around the world.

- Best FX Rates, Cheaper than Banks

Gain access to mid-market FX rates and transparent fees for payments anywhere. Receive these significant savings and you will never use banks for cross-border payments again.

- Direct and Faster than Wire Transfers

Connect directly to our network of payment partners around the world and skip the middlemen! You will avoid extra fees and process payments quicker.

- Global coverage

Make international payments with any of our 46 supported currencies in 180 countries from our platform. Pay invoices easily in currencies using USD, SGD, GBP, AUD, EUR, MYR, JPY, PHP and more!

- Dedicated support

All our business account customers will be assigned a dedicated local account manager, ready to support any single query through mobile or Whatsapp.

Collect

You will be able to get bank details with different local currencies, be it the US, UK, Europe, Singapore or Indonesia. Your business can operate as if you have a local currency bank account.

- Better rates for your business

Receive funds in multiple currencies such as USD, GBP, EUR, IDR with no additional charges. With an international receiving account, you get to reduce FX loss by avoiding unfavourable rates and fees imposed by banks.

- Better rates for your customers

Provide your clients with an easier, cheaper and faster way to pay you with their preferred currency and local transfer methods so as to prevent any charges on international transfers.

- Faster Account Opening

Get USD, EUR, GBP account details in your company name for free instead of opening local bank accounts overseas. Save time and money.

- Better Financial Control

Save on working capital needs with no minimum balance requirements for accounts and bank charges. Centralise all collections in your Wallex wallet and gain from clear reconciliations and reporting.

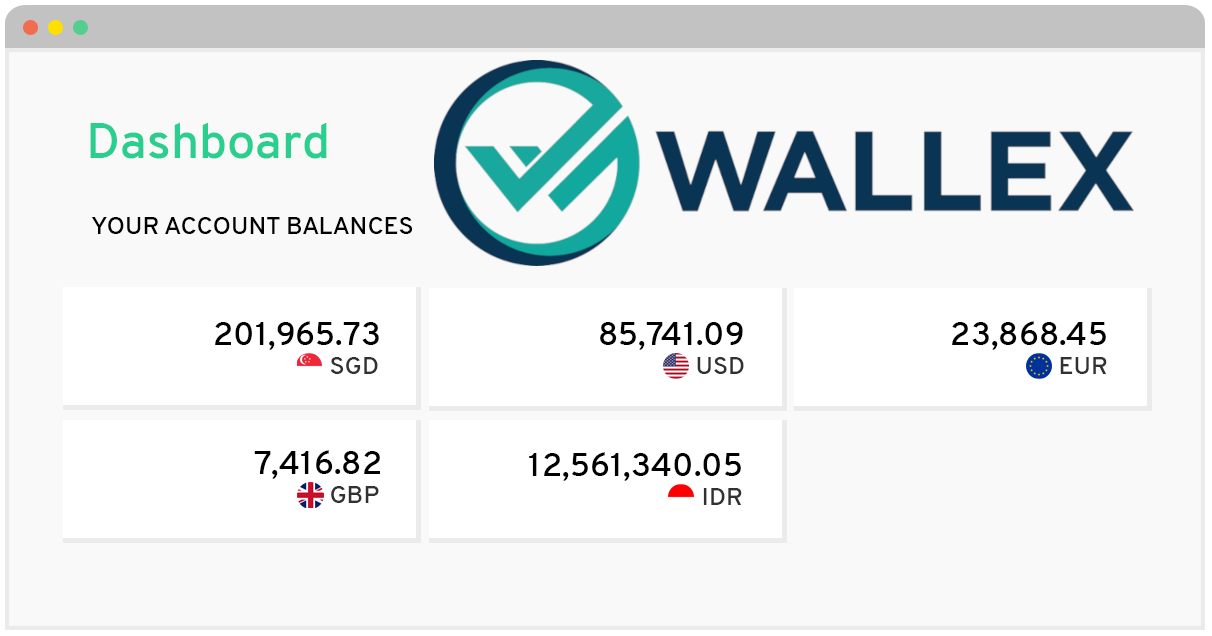

Multi-Currency Wallet

Hold and manage multiple currencies. Connect your wallet seamlessly to global payments, FX and virtual accounts for an easy international payment solution.

- Fast FX, free to begin

Manage your funds between balances and currencies using your online wallet within seconds.

- Support at your fingertips

Our multilingual customer support team is always ready to assist you with every transaction you make.

Conversions

Convert FX to 47 currencies at near mid-market rates. It’s absolutely free to get started!

- Simple & Powerful Conversions

Easily manage and convert the currencies you need for your global payments or retain funds to hedge against volatile FX markets.

- Competitive exchange rates

With Wallex, you get access to mid-market competitive rates. Save even more when you trade in larger volumes!

Wallex’s solutions has been used by over 20,000 users!

Wallex Frequently Asked Questions (FAQ)

Wallex has the ability to let you hold balances in different currencies. This allows you to hedge your foreign currency needs in advance in order to protect your business against unnecessary FX losses.

Wallex holds a licence as a Major Payment Institution, issued by the Monetary Authority of Singapore (MAS) under the Payment Services Act 2019. It is also licensed and regulated in both Hong Kong and Indonesia. All customer funds are safeguarded and kept in a customer segregated account which is kept separate from all other Wallex operations accounts. Wallex operates within a very strict framework both for compliance and for the security of funds in their care.

When you transfer money via banks, you are not only charged a high processing fee but you also expose yourself to excessive FX margins. Besides, the entire process is also long and troublesome. With Wallex, you immediately gain access to rates that could reduce your transaction fees by as much as 70%. In addition, international payments can be completed within minutes.

For international payments using Singapore Dollar and Indonesian Rupiah, the average processing time is under an hour. There is also provision for same day payments for 20+ currencies including USD, EUR, GBP, HKD, INR, MYR and more for funds that are received before the daily cut off time. While depending on the currency you are making the payment in, you can always expect your payment to reach within the same day or up to 2 working days upon our receipt of your funds.

Wallex’s platform is built with business operations in mind. It has the capability to handle high value frequent transactions on your behalf. With the Bulk Payments feature, you can set up and run multiple transactions concurrently.

Yes. You can immediately open a global receiving account in SGD, USD, Euro, GBP and IDR. Your customers can pay you in these currencies as if they were making a local payment. This saves you and your customers not just money but also a lot of time.

It’s absolutely free to open an account! There are no charges for any subscription or maintenance fees. No fees are charged for receiving money too. There are no minimum balance requirements either. Wallex simply charges a flat % fee based on the currencies that you wish to make a payment in. That’s it. The conversion is done at extremely competitive near mid-market rates as Wallex believes in price transparency. No more expensive exchange rates!

Team 361 is an official authorised partner of Wallex. Being a leading cloud integrator, we are proud to represent multiple software solutions. We provide unbiased recommendations and will only propose the most appropriate and value-for-money solutions for you, including the information on relevant grant support available.