Our Finance Minister, Mr Lawrence Wong, has just delivered the new Budget 2023 “Moving Forward In A New Era” today.

The much anticipated 2023 Budget has just been revealed by Finance Minister Lawrence Wong.

In this year’s budget announcement, Minister Wong addressed several key issues that many Singaporeans are concerned with. He spoke about inflation worries and the impact of rising costs on the daily lives of Singaporeans.

Reassurance was given that more steps will be taken by the government to support vulnerable locals, particularly the lower-income groups and the seniors. These are the ones who will be adversely affected by the higher cost of living and higher GST. Once-off payments of between $200 to $400, as well as GST Vouchers, will be given to eligible Singaporeans and households.

For businesses, Minister Wong’s advice was to get themselves well-prepared for the future, amidst the pending uncertainties and challenges. He appealed for businesses to engage in continuous upgrading, invest in innovation and training, as well as ensuring that their workers reskill and upskill in order to stay competitive and relevant.

Let’s take a look at how the new budget will impact businesses in the upcoming fiscal year.

1. Extension for Enterprise Financing Schemes to 31 March 2024

-

- 70% government risk-share for trade loans

- Enhanced maximum quantum for trade and working capital loans

- Enhanced project loans to support domestic construction projects

2. Extension of Energy Efficiency Grant to 31 March 2024

-

- Encourage SMEs in Food Services, Food Manufacturing and Retails sectors to adopt energy efficient equipment. Learn more HERE.

3. National Productivity Fund

-

- $4 billion top-up to expand scope and support more investment

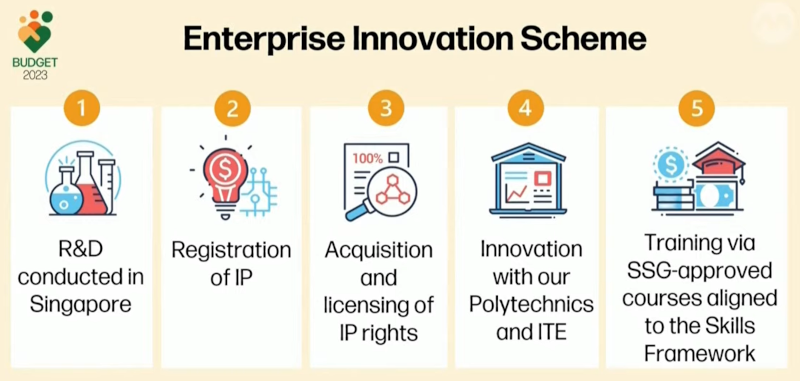

4. Enterprise Innovation Scheme (New!)

-

- Enhanced tax deductions of up to 400% of qualifying expenditure for each of the 5 key activities

- Capped at $400,000 for each activity, except for innovations with Polytechnics and ITEs which will be capped at $50,000

- Businesses with little or no taxes can have the option to convert 20% of their total qualifying expenditure per Year of Assessment to a cash payout of up to $20,000

5. SME Co-Investment Fund

-

- Additional $150 million to invest in promising SMEs

- Another $300 million in private investment

6. Global Enterprises Initiative

-

- $1 billion for promising companies to engage in specialised capability building programmes

- Working with experts to strengthen core leadership team, accelerate internationalisation plans and build a strong talent pipeline

- Enterprise Singapore will provide relevant support

7. Introduction of Jobs-Skills Integrators (New!)

-

- Integrators will link up industry, training and employment facilitation partners to optimize training and placement, as well as close skills gaps

- Training has to translate into tangible positive outcomes and better earnings for workers

- Pilot with the Precision Engineering, Retail and Wholesale Trade sectors first

8. Extension of Senior Employment Credit to 2025

-

- Continuation of wage offsets for businesses that employ senior workers

9. Extension of Part-Time Re-employment Grant to 2025

-

- Encourage businesses to offer part-time re-employment opportunities for seniors

- Grant of $2,500 per senior worker

- Learn more HERE

10. Progressive Wage Credit Scheme

-

- $2.4 billion top-up to the fund to maintain government’s co-sharing portion of eligible wage increases for low wage workers

11. Enabling Employment Credit

-

- Support employers to hire persons with disabilities (PwDs)

- Enhanced wage offsets

- Longer duration for PwDs who have not been working for at least 6 months

12. Uplifting Employment Credit (New!)

-

- Time-limted wage offset to encourage businesses to employ ex-offenders

Join our 361DC Post-Budget 2023 Event!

You are invited to our post budget event to learn how your business could benefit from it!

If you are our existing client, do contact your consultant to find out how you can get a seat for free.

Comments are closed.